Real estate has long been considered a reliable and lucrative investment option. It offers numerous benefits, such as potential rental income, property appreciation, and tax advantages. However, making a wise investment in real estate requires a comprehensive understanding of the concept of return on investment (ROI). In this blog post, we will delve into the various aspects of ROI in real estate and how you can maximize your wealth through smart property investments.

What is Return on Investment (ROI)?

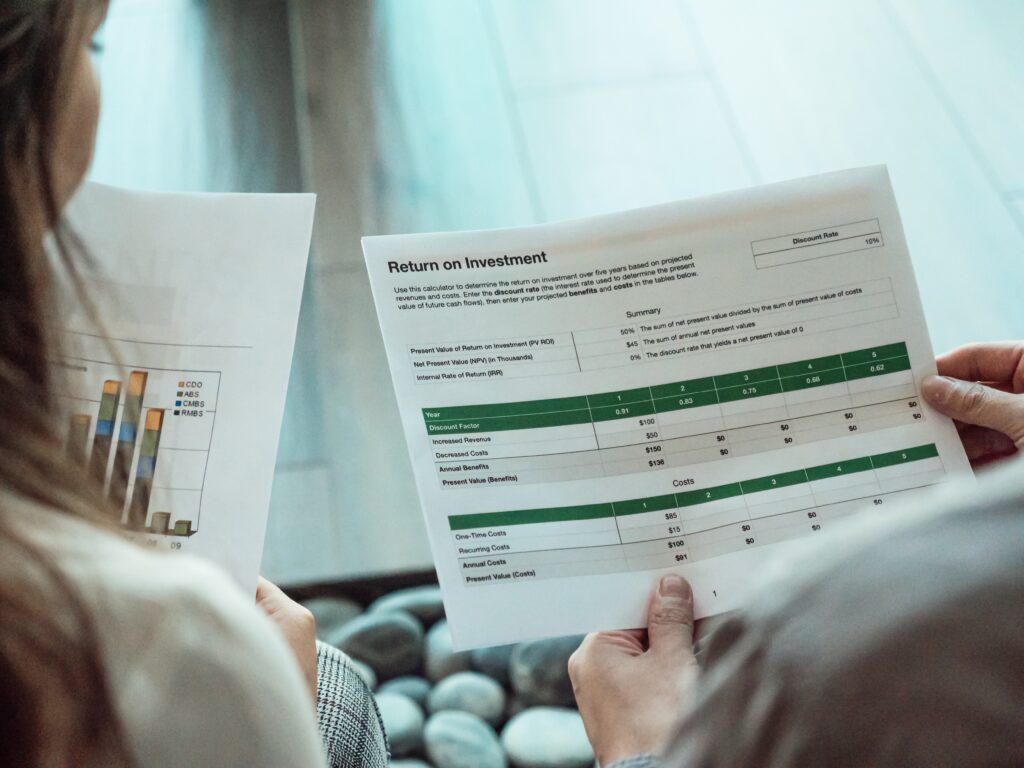

Return on Investment, often abbreviated as ROI, is a financial metric that measures the profitability of an investment. It is a crucial tool for evaluating the performance of real estate investments. ROI is expressed as a percentage and is calculated by dividing the net profit generated from an investment by the initial cost of the investment. In real estate, ROI is commonly used to assess the return a property owner can expect to receive.

Calculating ROI in Real Estate

To calculate ROI in real estate, you need to consider several factors:

Rental Income

If you’re purchasing a property with the intention of renting it out, your rental income is a significant part of your ROI. This includes monthly rent received from tenants minus any expenses related to property management and maintenance.

Property Appreciation

The increase in the property’s value over time is another element of ROI. While property values can fluctuate, real estate historically appreciates in the long run.

Operating Expenses

Operating expenses include property taxes, insurance, maintenance, and property management fees. Subtract these expenses from your rental income to determine your net operating income (NOI).

Financing Costs

If you financed the purchase of your property with a mortgage, you’ll need to account for the interest and principal payments in your ROI calculations.

Time Horizon

Consider the length of time you plan to hold the property. A longer investment horizon can allow you to benefit from both rental income and property appreciation.

Maximizing ROI in Real Estate

Location, Location, Location: The importance of location cannot be overstated in real estate. Properties in desirable neighborhoods tend to appreciate more quickly and generate higher rental income. Different types of properties offer varying ROI potential. Consider factors like single-family homes, multi-family units, commercial properties, and vacation rentals when making your investment decision.

Financing

Choosing the right financing option can significantly impact your ROI. Low interest rates and favorable loan terms can boost your returns.

Property Management

Efficient property management can reduce vacancy rates, maintenance costs, and hassle. Consider professional property management services to maximize your ROI.

Diversification

Don’t put all your eggs in one basket. Diversify your real estate investments to spread risk and potentially increase your overall ROI.

Stay Informed

Real estate markets are dynamic. Stay informed about market trends, economic conditions, and local developments that can affect your property’s ROI.

Return on Investment (ROI) is a critical concept in real estate investing. By understanding how to calculate and maximize ROI, you can make informed decisions that will help you build wealth over time. Keep in mind that real estate investing carries risks, and it’s essential to conduct thorough research and seek professional advice when necessary. With the right approach and a long-term perspective, real estate can be a powerful vehicle for growing your financial portfolio and securing your financial future. Dwelling Network can assist you in understanding the earning potential of your investment and be your trusted partner through your real estate investment journey.